The Evolution of Cryptocurrency

The Illusion of Financial Freedom

In the rapidly evolving world of cryptocurrency, it's crucial to have an honest conversation about where we've been and where we're truly headed. As someone who's been in this space for years, I've watched the landscape transform dramatically, and my perspectives have shifted along with it.

The Bitcoin Dilemma: A System Within the System

Remember when Bitcoin was the rebellious outsider, promising to revolutionize finance? Those days are long gone. Now, it's hard not to see Bitcoin HODLers as desperate believers, waiting for the likes of JP Morgan to make them rich. It's almost comical – like infants expecting daddy to deliver their fortune.

Don't get me wrong, Bitcoin played a crucial role in cryptocurrency adoption. Without it, most people wouldn't know what cryptocurrency is. Financial news outlets like Bloomberg keep the general public interested, which is significant. But here's the harsh truth: Bitcoin is no longer the people's currency. It's become so entangled with the very system it was meant to challenge that we've lost control.

The HODL Trap: A Game Rigged Against Us

For a long time, I was loyal to BTC. The limited supply, the ETFs, the constant "HODL" posts promising skyrocketing prices – it all seemed so promising. But over time, I realized this was nothing more than emotional manipulation. We're leaving our financial fate in the hands of BlackRock's price manipulation tactics.

What's worse, the Federal Reserve can now manipulate Bitcoin's price at an accelerating rate, far beyond what they ever did with the USD. BlackRock is pumping and dumping the price, playing with fear, greed, and panic, aided by media and legitimate brokers. Most small HODLers have lost so much and are exhausted. By the time they get their share of the pie, it will be the smallest crumbs.

Sure, these crumbs might be more than the average person has, but in contrast to the wealthy institutions who HODL, living off crumbs is the same mentality that got us here in the first place. This isn't freedom; it's the USD on steroids.

The Illusion of Mainstream Adoption

Mastercard is promising crypto cards that can be used everywhere, focusing on BTC and ETH. China is decriminalizing cryptocurrency, and Russia is allowing it for mining operations. These might seem like steps towards freedom, but they're just tightening the system's grip on what was meant to be a decentralized currency.

A Call for True Financial Revolution

As Bitcoin's flaws become more apparent, we need to look for alternatives that stay true to the original vision of cryptocurrency. We need systems that prioritize privacy, true decentralization, and resistance to manipulation by large institutions.

But let's not make the same mistakes we did with Bitcoin. Any new cryptocurrency shouldn't be treated as a get-rich-quick scheme. It should be used for what it's designed for – private, secure transactions that give power back to the individual.

Lessons from History

This reminds me of my experience with the marijuana legalization movement. While decriminalizing marijuana was a victory for many, it had unintended consequences for regular people in cities who relied on it as a means of survival. Progress can be slow, and sometimes that's okay. We need to be mindful of the broader implications of rapid change, especially when powerful institutions are involved.

The Road Ahead

The crypto space isn't what it was in 2013. It's gone mainstream, and with that comes new challenges. If major players like JPMorgan and BlackRock lose interest, they have the power to sway public opinion through media and brokerage firms. Mass adoption could be set back by years, or worse, molded into something that serves the elite rather than the masses.

As we move forward, let's be smart about how we approach cryptocurrencies. Avoid the greed and haste that characterized the early days. Understand that true financial freedom might not come from the coins that are most heavily promoted by the mainstream financial system.

The future of crypto is still being written. Let's make sure we're writing it with clear heads and open eyes, not blinded by the false promises of overnight riches or misplaced loyalty to any single coin. It's time to reclaim the original vision of cryptocurrency – a truly decentralized, private, and manipulation-resistant financial system for all.

#Crypto Death Spiral Incoming By Jared Schlar April 29, 2021 #GME #Stocks #Reddit #Financial

The crypto bull run has been a free ride, 2021 experienced the greatest bubble so far, how long will this last? This current trend seems difficult to understand, and different from other times, a bunch of people live in disbelief of this new phase.

📊 Embarking on My Crypto Journey:

As I embark on my personal quest to gauge future competition and potential wealth in the crypto arena (hoping to escape my current state of pennilessness!), let's dive into the numbers.

Big Tech is killing Crypto!

Recently, I had someone fraudulently open a Bank of America Checking Account in my name.

#GME Infinity Squeeze or #MarketCrash? By Jared Schlar | #CryptoBlog

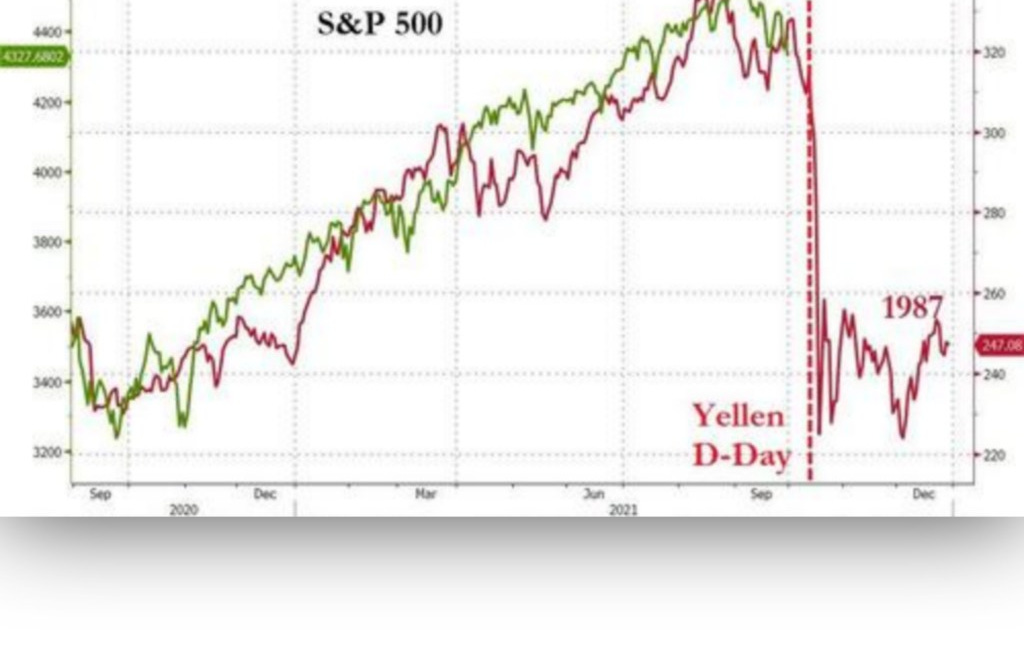

I see many comparisons to the 1987 flash crash. The signs are visible everywhere. Some headlines include: