Monero's Value Beyond Privacy Utility:

A Superior Asset for Financial Sovereignty

Monero (XMR) stands out as one of the most valuable cryptocurrencies in terms of privacy, fungibility, and decentralization. While Ethereum (ETH) is often regarded as a leader in smart contracts and decentralized applications (dApps), its core structure and centralized control over network upgrades present serious challenges for its long-term sustainability. In this post, we will explore Monero’s value as an asset beyond its utility, especially in comparison to Ethereum, which despite its broad use case, doesn’t match Monero's level of true decentralization.

1. Monero’s Controlled Supply and Tail Emission Model

Monero’s supply dynamics are designed to ensure scarcity while maintaining long-term miner incentives. While Bitcoin and Ethereum have a fixed or predictably reducing supply, Monero follows a "tail emission" model that guarantees a small but constant creation of new XMR beyond 18.4 million coins. This controlled inflation (0.8% per year) serves several purposes:

Network Security: The continued issuance of XMR ensures miners remain incentivized to validate transactions, maintaining Monero’s decentralized and secure network.

Predictable Scarcity: Unlike Ethereum, which has an unlimited supply potential due to its Proof-of-Stake issuance, Monero’s tail emission creates a controlled, predictable inflation rate that makes it resistant to sudden inflationary spikes while still preserving long-term scarcity.

Ethereum, on the other hand, has no fixed supply cap—meaning there is potential for an ever-increasing supply, especially given the transition to Proof of Stake (PoS) and staking rewards. While Ethereum introduced EIP-1559 with a burn mechanism that removes ETH from circulation, the supply is still unpredictable and could increase if network activity decreases. For a true deflationary asset, Monero’s model offers more stability.

2. Fungibility and Censorship Resistance: The Core of Monero’s Value

Monero’s most powerful feature is its fungibility, a property that ensures every unit of the currency is identical and interchangeable. This is achieved through Ring Signatures, Stealth Addresses, and RingCT, which guarantee transaction privacy and prevent coins from being tainted by prior transactions. This level of privacy makes Monero impervious to blacklisting, unlike Bitcoin and Ethereum, where certain coins can be traced and flagged for illicit activities.

In contrast, Ethereum's fungibility is compromised by its transparent ledger. Transactions on Ethereum are fully traceable, and some Ethereum coins might be subject to sanctions or restrictions if they’re deemed associated with criminal activity. For those seeking purely fungible assets, Monero provides a distinct advantage.

Furthermore, Monero's privacy features give it an edge as an asset for financial sovereignty. As governments and centralized financial systems push for more control and surveillance over digital currency transactions, Monero offers an alternative that is resistant to censorship.

3. Decentralization: Ethereum’s Weakness

While Ethereum markets itself as a decentralized platform, the reality is that it is far more centralized than many realize. The transition to Proof of Stake (PoS) has concentrated control of the network in the hands of a few large staking entities. The high barrier to entry for staking and the dominance of large centralized exchanges means that Ethereum’s governance and decision-making processes are often influenced by a small number of players.

In contrast, Monero’s network is highly decentralized, with mining participation open to anyone, and a community-driven development process that ensures the network stays true to its privacy-focused, censorship-resistant ethos. There’s no central authority, no large entities controlling the consensus, and no risk of becoming beholden to the interests of institutional stakeholders.

Ethereum, despite its reputation, is increasingly centralized in both its validator set and its developer community. This centralization undermines Ethereum's original vision as a fully decentralized platform and makes it vulnerable to influence from large stakeholders, potentially leading to governance issues and a loss of decentralization over time.

4. Monero’s Hedge Against Financial Control

Monero’s privacy and censorship-resistant features also make it an attractive asset for individuals concerned about increasing government surveillance and financial control. With global trends towards financial regulation tightening and crypto transactions coming under scrutiny, Monero stands as a safe haven for wealth preservation outside the reach of state actors.

While Ethereum has significant use cases in decentralized finance (DeFi) and decentralized applications (dApps), it remains tethered to the traditional financial system. Ethereum's reliance on centralized exchanges for liquidity, its exposure to regulatory scrutiny, and its transparent blockchain make it a less secure choice for users who prioritize privacy.

Monero, in contrast, remains an ideal asset for users who value autonomy, anonymity, and the ability to transact freely without interference from financial institutions or governments. As the world becomes more digital and surveillance-oriented, Monero’s privacy features become even more valuable.

5. Community and Network Effects: Monero’s Strong Foundation

Monero is not just an asset; it’s a movement driven by a passionate, privacy-focused community. Its development is community-driven, open-source, and resistant to outside influences. This grassroots ethos gives Monero its resilience and ensures that it evolves in line with the needs of its users.

The Monero community is committed to making sure the network remains decentralized, censorship-resistant, and privacy-centric. In contrast, Ethereum’s community is often divided, with major decisions and upgrades frequently influenced by large stakeholders. This centralization creates risks for Ethereum’s long-term future.

Conclusion: Why Monero is the Superior Asset

Monero’s value extends far beyond its utility as a privacy-focused currency. Its controlled supply via tail emission, fungibility, and strong decentralization make it a superior asset for anyone seeking financial sovereignty in an increasingly controlled world. The privacy-preserving features and resistance to censorship give Monero an edge over Ethereum, which is increasingly centralized and vulnerable to state surveillance and regulation.

Monero isn’t just an asset for today; it’s an asset for tomorrow, offering long-term stability, privacy, and security. As Ethereum becomes more centralized and exposed to regulatory challenges, Monero’s niche in the cryptocurrency landscape grows stronger, ensuring its place as a future-proof asset in the world of decentralized finance.

https://x.com/VictorMoneroXMR/status/1873806944697540996

Big Tech is killing Crypto!

Recently, I had someone fraudulently open a Bank of America Checking Account in my name.

#Crypto Death Spiral Incoming By Jared Schlar April 29, 2021 #GME #Stocks #Reddit #Financial

The crypto bull run has been a free ride, 2021 experienced the greatest bubble so far, how long will this last? This current trend seems difficult to understand, and different from other times, a bunch of people live in disbelief of this new phase.

#GME Infinity Squeeze or #MarketCrash? By Jared Schlar | #CryptoBlog

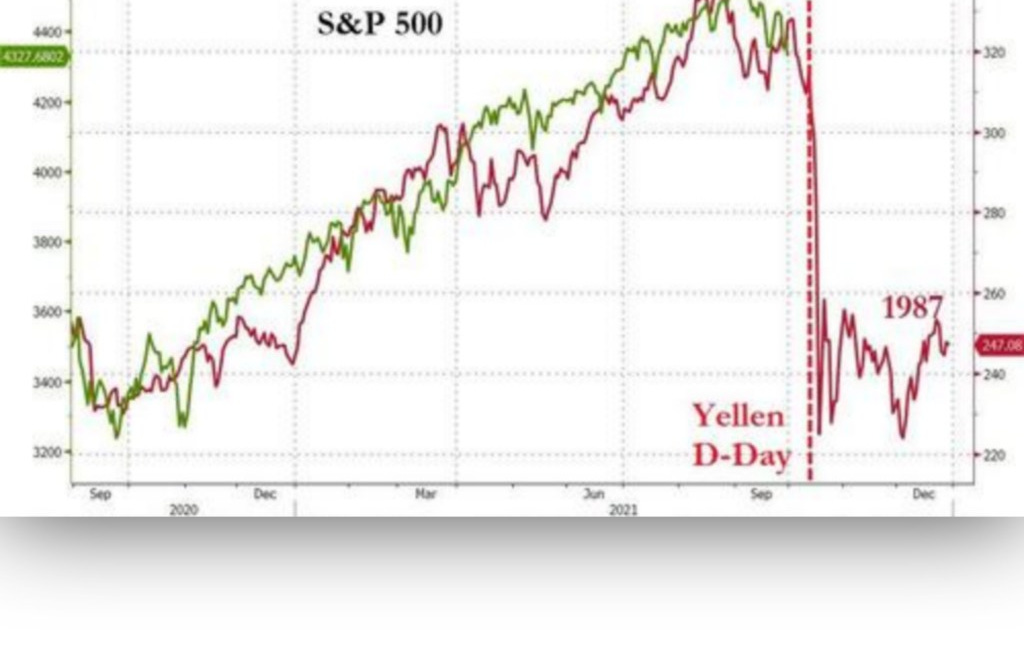

I see many comparisons to the 1987 flash crash. The signs are visible everywhere. Some headlines include:

Why You Should Avoid Staking ETH on Trezor

With Ethereum's shift to proof-of-stake (PoS), staking ETH has become an appealing way for crypto holders to earn passive income. However, users of hardware wallets like Trezor who want to keep their assets secure are increasingly turning to third-party providers to stake their ETH. Unfortunately, as some users on forums like Reddit’s

Top Cryptocurrency Spot Exchanges:

Top Cryptocurrency Spot Exchanges: How to Opt-Out and Close Accounts