FinTech Being Sabotaged

FinTech Being Sabotaged: By Big Oil?!

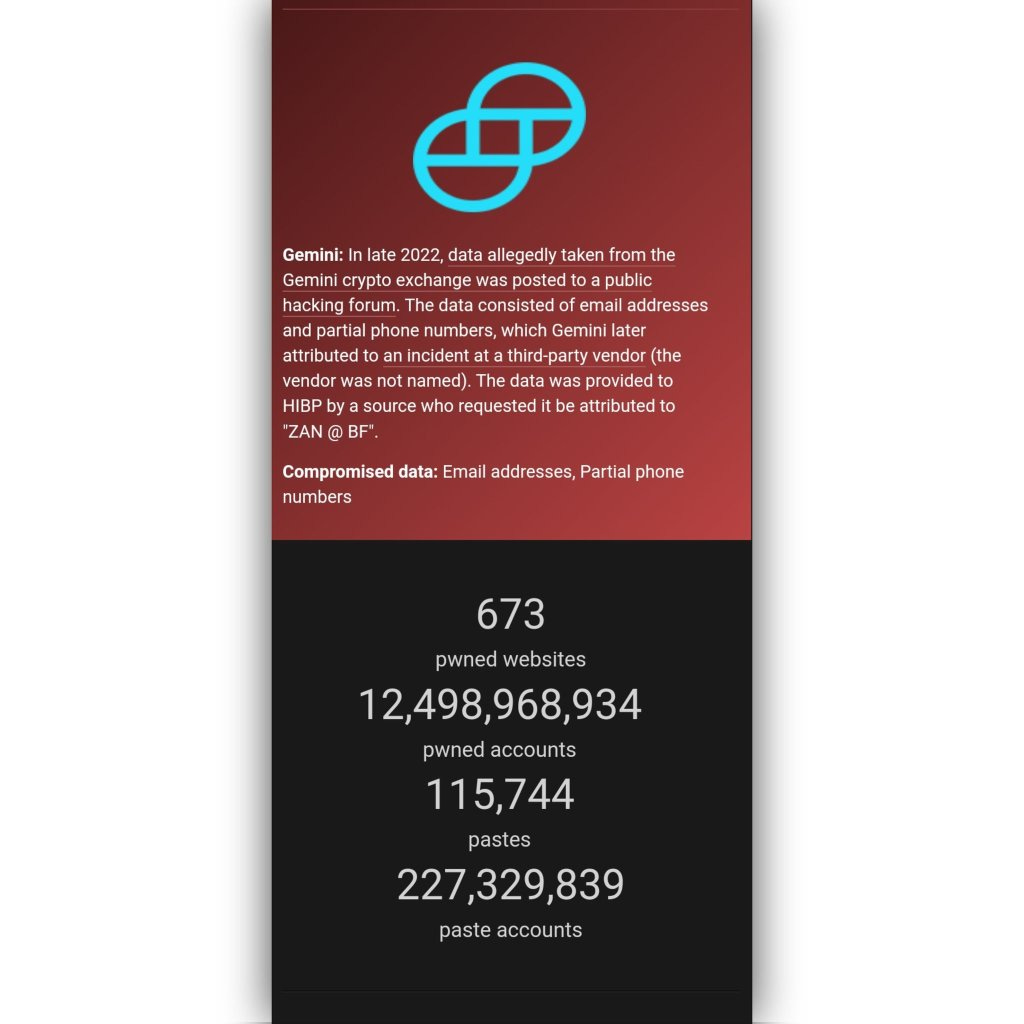

I believe Gemini was nothing more than a honeypot to steal KYC info for the Feds,

and WebBank their lender seems to be purposely disrupting the crypto industry by lending to companies involved with the same types of fraud.

It would appear that the FDIC is in Cahoots with WebBank;

and that makes sense because WebBank was founded by the steel industry,

and steel production is dependent on big oil money, as is the FDIC dependent on the petrol dollar as well.

Oil plays the strongest role in determining the price of steel, as when oil is cheap, shipping raw and finished materials costs less, and when oil prices rise, steel prices rise. The price of steel varies daily based on supply and demand, the strength of the American dollar,

seasonality, and global pandemics. Different industries such as automobile, aerospace, construction, and technology can also affect the value of scrap metal.

— DANIEL BRUMMITT (@dan__brummitt) June 6, 2023

I’m at a conflict of interest reporting on this,

because I sure as heck don’t want the WEF gaining full dominance with their fake humanitarian/ climate change agenda’s to push global fascism,

thus erasing all of our cultural identities.

Fracking and endless wars seem minor compared to what the WEF has publicly stated they have in-store for us.

I believe that representative(s) at FDIC are not working in the interest to protect consumers,

because in my recent experience one of them was acting like a PR manager for the bank I was having an issue with.

In a recent phone call with the FDIC,

the representative said that it’s normal protocol for banks to request additional info when an account is flagged;

he then accused me of not complying with the banks protocol, which is not only manipulative, but also untrue.

He stated that the purpose of the protocol is to protect my identity.

Problem with what the representative said to me is that everyone’s account was flagged,

there is currently a class action lawsuit against Gemini specifically over the Earn Program.

Gemini already has my info, why would a hacker pay my bill for me, lol?

The issue I was having with Gemini was that they were blocking me from being able to pay my credit card balance. Apparently, this is a common reported practice by many companies funded by WebBank to force debt and collect on the interest.

I don’t think it’s right for a representative of the FDIC to assist WebBank and Gemini to coerce me or anyone into giving info that was never needed to open the account in the first place, let alone, I made it very clear how I don’t feel safe giving the additional info based on both WebBank + Gemini’s track record.

FTC Returns More Than $3.7 Million To Consumers Harmed by Online Lender Avant:

Avant branded credit products are issued by WebBank.

Prosper Marketplace Sued Over Credit Report Claims

In partnership with Prosper Marketplace, WebBank is the lender of fixed-rate, unsecured personal loans for debt consolidation, home improvements, and more…

https://www.sec.gov/news/press-release/2019-58

Silicon Valley Company Prosper Funding LLC Settles Fraud Charge for Misstating Returns to Investors: (Oh, that sounds familiar. Just like Gemini, lol. This is right out of the WebBank playbook.)

I spoke with Andrew of the @FDIC today, he's the one handling my case. @FDIC_OIG

He said that my account with #WebBank is still active. https://t.co/joB35VsLCW— DANIEL BRUMMITT (@dan__brummitt) June 5, 2023

So, if, when or ever; regulatory agencies handling my case ask me why I wouldn't "re-give" my #KYC info to #Gemini to regain access to my account… This is why!

Snakes, man!

Always trust your gut! #GeminiEarn #WebBank #WinklevossCapital #Mastercard https://t.co/WDfbAIw5SJ pic.twitter.com/u4FSZuxVBL— DANIEL BRUMMITT (@dan__brummitt) May 12, 2023

The post FinTech Being Sabotaged appeared first on Disruptive Fine Art.