In the ever-evolving landscape of technology and innovation, investors are constantly on the lookout for opportunities that promise growth and sustainability.

Two prominent players in this realm, Ark Innovation ETF (ARKK) and Nvidia (NVDA), present intriguing options.

However, in this article, we'll delve into why ARKK could be a compelling investment choice in contrast to Nvidia.

1. Focus on Disruption and Innovation

ARKK, managed by the visionary Cathie Wood, is renowned for its laser focus on disruptive and innovative technologies.

The ETF invests in companies leading the charge in fields like artificial intelligence, robotics, and genomic sequencing.

This concentration on cutting-edge sectors positions ARKK as a potential front-runner in the long-term tech revolution.

On the other hand, Nvidia, a powerhouse in the graphics processing unit (GPU) market, has faced recent challenges.

Cathie Wood points out concerns about overbuilding GPU capacity without a corresponding surge in software revenue.

The potential pause in spending and correction in excess inventories could impact Nvidia's data center sales, raising questions about the company's short-term outlook.

2. Cathie Wood's Insight and Track Record

Cathie Wood's reputation as a forward-thinking and innovative investor precedes her. Her successful early investments in companies like Tesla have solidified her status as a market influencer. While she may have missed Nvidia's recent rally, Wood's strategic vision and knack for identifying market leaders cannot be overlooked. Investors keen on following a proven visionary might find ARKK an appealing choice.

3. Diversification and Risk Mitigation

ARKK offers a diversified portfolio, spreading risk across a range of innovative sectors. This diversification can help mitigate the impact of poor performance from any single stock. In contrast, Nvidia's reliance on GPU technology for a significant portion of its revenue exposes it to specific market dynamics, potentially making it more susceptible to short-term disruptions.

4. Long-Term Potential of Innovation

Investors with a high risk tolerance and a long-term investment horizon may find ARKK's emphasis on long-term innovation aligning with their goals. While Nvidia has demonstrated impressive stock gains, ARKK's focus on emerging technologies positions it as a potential beneficiary of the next wave of disruptive innovations.

Conclusion

In the dynamic world of tech investments, the choice between ARKK and Nvidia boils down to your investment objectives, risk appetite, and belief in the future of technology. ARKK, with its innovative focus, diversified portfolio, and the visionary leadership of Cathie Wood, offers a unique proposition for those looking to ride the wave of technological disruption.

While Nvidia has been a stalwart in the GPU market, concerns raised by Wood regarding overbuilding and competition may give investors pause. As always, it's crucial to conduct thorough research, consider your financial goals, and consult with a financial advisor before making any investment decisions. In the end, the key is to align your portfolio with the trends and technologies that you believe will shape the future.

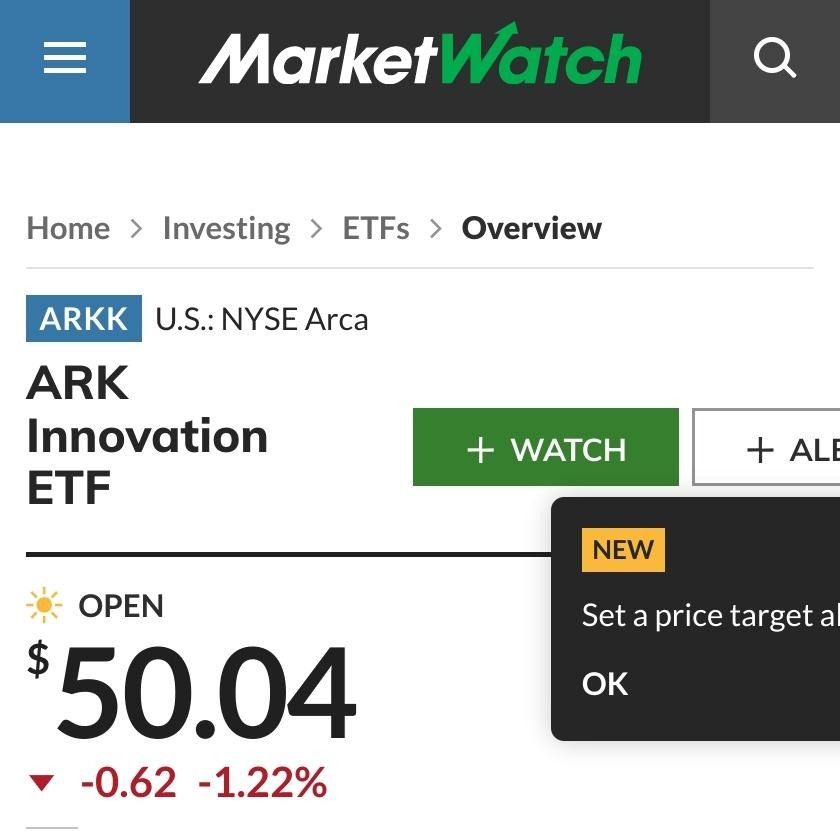

Here is something from Marketwatch.com that might interest you:

Cathie Wood sounds warning about Nvidia, whose rally she missed

https://www.marketwatch.com/story/cathie-wood-sounds-warning-about-nvidia-whose-rally-she-missed-9ee0b26b?reflink=mw_share_email

Lithium Americas Positioned for Growth

In the dynamic world of materials companies, Lithium Americas (LAAC) stands out with positive indicators, garnering attention from analysts and investors alike. Let's delve into the insights provided by Scotiabank, shedding light on the company's potential and future prospects.

Cardano's March 2024 Roadmap

In the fast-evolving landscape of blockchain technology, Cardano is gearing up for a robust March 2024 with a set of key priorities, co-signed by none other than the project's creator, Charles Hoskinson. https://u.today/key-cardano-priorities-for-march-2024-co-signed-by-ada-creator